- Home

- Loan Origination

Reimagine your lending platform to drive responsible growth.

Increase efficiencies, create better customer experiences and streamline your customer journey with our scalable cloud-enabled and configurable Loan Origination banking solution.

Our expertise

Customer experience must be frictionless, seamless and fast.

Customers are buying homes, not houses; businesses and livelihoods, not properties. This means having a secure, seamless end-to-end loan origination platform that helps your customers reach their end goal, effortlessly and as quickly as possible, is paramount.

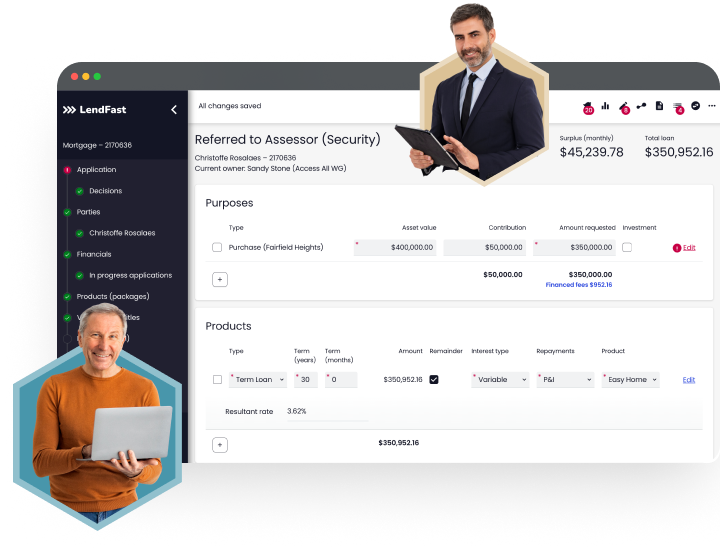

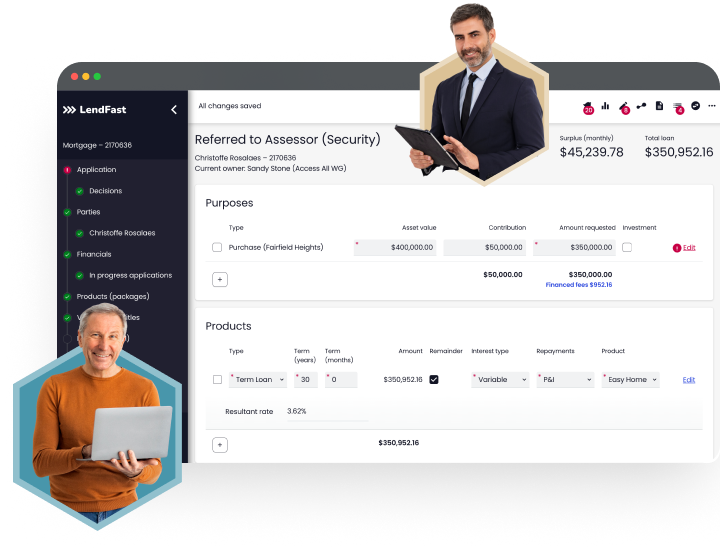

With both front end and back-end capability, our loan origination solution LendFast caters for retail, consumer and business lending, across direct-to-consumer, call centre, in-branch, relationship manager and broker channels.

With customer centricity at the core, Sandstone Technology’s LendFast solution empowers you to increase efficiencies, drive growth, reduce your operational costs, with security and compliance at its heart.

%

Increase in lending volumes with faster time to YES

%

Of credit assessor capacity freed up to focus on complex applications.

%

Reduction in application effort when applying online.

.png?width=528&height=364&name=Stop_repeating_research.png%20(1).png)

Discover the benefits of our loan origination solution to support your financial institution

Our one stop shop automated solution LendFast offers everything your financial institution needs, including:

- Automated workflows, decisioning and flexible data capture.

- Digital intelligent document verification tools with cutting-edge AI technology and Machine Learning to automate data verification.

- Ongoing regulatory and security compliance in line with evolving requirements.

- Trackers to maintain full visibility of the application journey for the customer, bank user or broker.

- Highly configurable to meet your business rules and flexibility to make changes to meet market demands.

- Pre-integrated third-party solutions and out-of-the box configuration

- And so much more

Our impact on the financial landscape

Great Southern Bank, Australia

40% of loan applications approved in less than two days

Great Southern Bank together with Sandstone Technology re-imagine the home lending experience to deliver a robust out-of-the-box lending origination platform.

Discover how Sandstone's loan origination enabled the bank to reduce operational, compliance, credit risk, and automate manual tasks to allow the bank to focus on other important things such as the customer experience.

Frequently Asked Questions

What is Digital Loan Origination?

An end-to-end automated platform that streamlines the loan application and approval process.

What types of loans can be processed through Sandstone's platform?

Mortgages, personal loans, SME loans, and credit cards.

How does a digital loan origination system improve the loan application process for customers?

By offering a fast, paperless experience with real-time approvals and digital document submission.

Can it integrate with our core banking system and third-party services?

Yes, it has flexible APIs for seamless integration with core banking, Open Banking, and risk assessment tools.

What should I consider when choosing a loan origination system?

Some key considerations include automation capabilities, integration with existing systems, scalability and security, and compliance to meet regulatory requirements.

How does automation benefit the loan origination process?

Automation streamlines workflows, minimises manual errors, accelerates decision-making, and improves overall efficiency.

How does Sandstone’s Loan Origination system (LOS) improve efficiency for lenders?

Our LOS automates credit decisioning, document collection, and compliance checks, reducing approval times and improving operational efficiency.

Does the system support digital lending and self-service loan applications?

Yes, it allows customers to apply for loans online, track their application status and complete the process digitally.

What is the difference between Loan Origination System (LOS) and Loan Management System (LMS)?

Loan Origination System deals with the loan application and approval process while Loan Management System handles loan servicing and collections after disbursement.

Can lenders self-service to adjust products, rates and business rules?

Yes, with our Configuration Manager (CM) module, Bank users can manage these configurations. It also supports approval workflows and audit logs for changes made to configuration parameters.

Request a demo and see how our Loan Origination solution can increase efficiencies!