- Home

- Digital Origination

Digital origination for efficiency and experience.

Simplify your digital onboarding and transform your lead capture to boost conversion rates with seamless customer experience.

Our expertise

Simple and frictionless lead and online application capture.

In today's dynamic financial services landscape, speed and certainty are critical. Amid fluctuating interest rates and economic uncertainties, consumers expect streamlined applications, smooth digital onboarding and the ability to enquire about products effortlessly.

Sandstone Technology’s customer-centric Digital Origination product suite enables FIs to meet these expectations. Our cloud-based solutions deliver engaging, hassle-free product enquiry and application experiences, while ensuring data accuracy and integrity, and real-time digital onboarding across a range of savings and lending products.

%

reduction in processing time on home loan applications

%

Increase in home loan

approvals

%

Decrease in data re-work

Efficient and user-friendly onboarding experiences

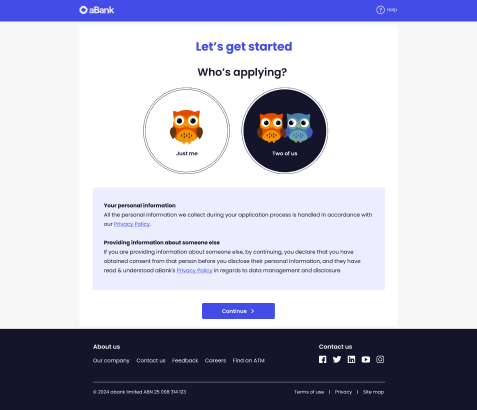

Discover our omni-channel, agile and future-ready digital origination suite that simplifies the onboarding journey, lead and application capture to grow your customer base through online and digital channels.

- Capture quality digital sales leads with Rapid Leads anywhere, anytime across your products.

- Easy-to-use Loan Application Research Assistant(LARA) calculators to help customers determine their borrowing power.

- Speed up onboarding and improve customer experience with Apply Lite offering secure, configurable forms for application capture.

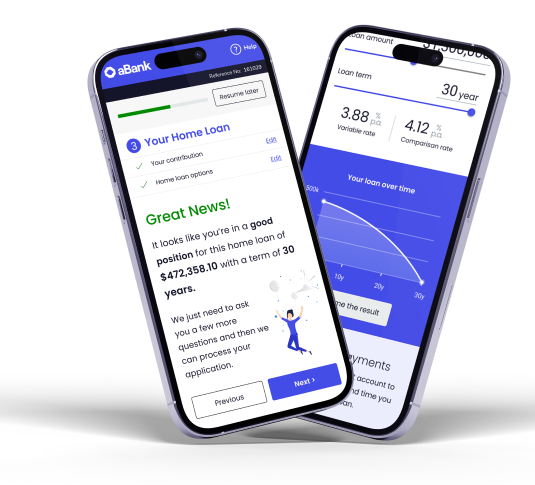

- Boost user engagement and satisfaction with Apply’s intuitive, user-friendly application capture interface.

- Achieve straight-through processing and real-time account opening for both saving and lending products.

- Compliant and secure ensuring data privacy

- And so much more

Ready to elevate your digital origination experience?

Take full control of your onboarding process and turn every interaction into an opportunity. Manage third-party providers, products and data capture easily — all the way through to final submission. By reducing customer attrition and delivering a consistent, device-agnostic experience, you keep customers engaged throughout the process.

With greater control and stability, FIs can improve customer satisfaction, reduce operational effort and drive growth. Our solution transforms digital origination, giving you the tools to streamline and enhance every stage of the process.

Our impact on the financial landscape

Great Southern Bank, Australia

40% of loan applications approved in less than two days

Great Southern Bank together with Sandstone Technology re-imagine the home lending experience to deliver a robust out-of-the-box lending origination platform.

Discover how Sandstone's loan origination enabled the bank to reduce operational, compliance, credit risk, and automate manual tasks to allow the bank to focus on other important things such as the customer experience.

Frequently Asked Questions

What is Digital Origination in banking?

Digital Origination is the process of a financial institution taking on new customers for their products and services via an online channel

How does Digital Origination improve the customer experience?

Customers are able to apply for new financial products 24/7 from anywhere, anytime, on any device.

How does Sandstone's digital lead generation solution help with lead capture?

It delivers high quality leads with tailored lead capture and qualification - reducing the manual process time for staff and customers both.

How does Sandstone’s Digital Origination platform improve the onboarding experience?

Our Digital Origination solution streamlines applications with automated decisioning, ID&V, KYC and AML checks reducing manual work while ensuring regulatory compliance.

Is Sandstone's solution suitable for banks, building societies, and credit unions?

Yes, our solution is designed for a variety of financial institutions such as banks, building societies, specialist lenders, and credit unions.

What types of products can be originated through this platform?

Home loans, personal loans, credit cards, and savings accounts.

Does your solution offer omni-channel support?

Yes, it provides a seamless experience across digital and physical channels.

Can your platform be integrated with Open Banking?

Yes, all our platforms are open banking ready.

Do you provide support and training for the FI's team?

Yes, we offer training workshops and ongoing support for a smooth transition.

Is the solution scalable as the customer base and offerings grow?

Yes, our solution is highly scalable to support growth and evolving business needs.

Request a demo and see how our Digital Origination solution can increase conversion rates!